The amount of data consumed by an average Ugandan telecom subscriber per month rose from 1.6 gigabytes (GBs) in December 2022 to 1.7 GBs in March 2023, a Uganda Communications Commission (UCC) report indicates.

Notably, this rise in data consumption was accompanied by a reduction in expenditure on data by 6% during the same period, implying that consumers are spending less but using more data. According to the quarterly report, telecommunications networks posted a combined 138.5 million GBs in downloads during the period between January – March 2023.

This is a 9.2 million GB growth in comparison with the 129.3 million GBs recorded at the end of December 2022. For the first time, the spike in internet traffic is inconsistent with the seasonal traffic drops that always occur following the November and December annual traffic peaks, says the report, attributing this largely to the continued adoption of internet usage by households and businesses of all sizes.

In terms of year-on-year comparison, the 12 months ending March 2023 witnessed a remarkable 51% surge in internet traffic, soaring from 91.4 million GBs in March 2022 to 138.5 million GBs in March 2023. As a result of this growth, the average internet service usage per subscriber reached 5.10 GBs in the quarter ending March 2023, compared to 3.88 GBs in the same quarter of the previous year, indicating a significant rise in data consumption.

Telephone subscriptions

The market performance report, which covers the telecom, postal and broadcasting sub-sectors, is based on information submitted by licensed operators. The report aims to provide readily available ICT indicators to policy makers to enable more evidence-based policy decisions; to provide easily accessible information to prospective investors; and to enhance consumer awareness and empowerment.

On telephone subscriptions, the report indicates that 1.08 million new mobile subscriptions were registered on Ugandan networks in the three-month period, bringing the overall subscriptions count to 34.3 million. This reflects a 3% increase in comparison to the previous quarter, the report added. This sharp growth in telephone subscriptions is attributed to the resumption of business activities after the festive season of December 2022.

With Uganda’s population projection for 2023 being 45.5 million, according to the Uganda Bureau of Statistics (UBOS), the telephony subscriptions penetration rate is now 75 active lines per 100 Ugandans, down from 77 in the quarter ending December 2022.

Internet subscriptions

During the quarter ending March 2023, internet subscriptions experienced significant growth, adding 1.2 million new internet subscriptions to record a total of 27 million. The consistent rise in internet subscriptions is attributed primarily to increased internet access through mobile devices. This growth in internet subscriptions has resulted in an internet penetration rate of 59 per 100 Ugandans, representing a 2% rise from the 57 per 100 Ugandans recorded in December 2022. In terms of year-on-year data comparison, there was an increase of 3.4 million active internet connections in the 12 months leading up to March 2023, representing a 14% rise in internet connections.

Mobile Money connections

Over the course of the three months – January to March 2023 – registered mobile money accounts increased from 36.8 million to 37.3 million, reflecting a growth rate of more than 500,000 new accounts. Regarding account activity, mobile money active accounts during the 90-day period grew from 25.2 million in the previous quarter to 26 million in March 2023. In addition, the agent footprint remained consistent, boasting a total count of 472,000 agents across the country, representing approximately 55 active wallets per agent.

In terms of year-on-year growth, an increase of 4 million new registered mobile money accounts was registered, reflecting a 12% growth since March 2022. Active new accounts (90 days) also increased substantially, with an additional 2.4 million new accounts, representing a 10% increase.

Mobile Money transactions

In the three months ending March 2023, the industry recorded 1.44 billion mobile money transactions, up from 1.40 billion transactions at the end of December 2022. This marks the first time the market has posted a positive net addition between the 4th quarter and 1st quarter of the year. This growth is associated with a spike in transactions such as Person to Person (P2P) transfers, utility and merchant payments, gaming, and school fees payments. In comparison to March 2022, the industry posted a net addition of 249 million transactions, from 1.2 billion transactions to 1.44 billion transactions in the quarter ending March 2023. This represents a 17% increase.

Network connected devices

The number of devices accessing the telecom network in Uganda grew by 3% from December 2022 to March 2023, reaching a total of 39.1 million. This growth is largely driven by smart devices that account for 21%, followed by feature devices at 17%. Conversely, basic handsets continued to witness a sharp 49% decline, which points to smart phones getting more affordable with some trading at $52 (UGX 190,000).

Domestic voice traffic

In the quarter ending March 2023, the market observed a 3% growth in domestic voice traffic, with a total count of 17.6 billion minutes in domestic talk time. Of these, 0.2 billion minutes were off-net (between two different networks) whereas 17.4 billion were on-net (same network) minutes.

At the end of March 2023, the growth observed in the off-net segment (15%) superseded that of the on-net voice traffic segment (3%) by 5 times. This points to a possible shift in behavior as consumers gradually switch from the on-net only voice centric bundles to the all-bundle (off net-on net combos) value prepositions offered by the different Mobile Network Operators.

Post & Courier sub-sector

The ICT revolution, the report states, has significantly impacted the postal sector, driving innovation to enhance efficiency, accessibility, and profitability. This reality motivated the Commission to engage with the postal and courier operators to understand the commercial and compensation status of the sector.

Thus, in the third quarter of the Financial Year 2022/23, the Commission successfully concluded the 2nd edition of the Postal and Courier stakeholder engagement session. The forum brought together key players in the Post and Courier market to address pressing sector matters, including e-commerce growth, logistics, and compliance obligations. The session culminated in the identification of key areas for action, such as enhancing enforcement against illegal operators, public awareness campaigns on diverse services and value propositions offered by the Post and Courier sector, as well as streamlining the licensing process for improved efficiency. Additionally, the stakeholders emphasized the importance of innovation and business transformation as crucial factors to stay relevant and adaptive in an ever-evolving landscape.

Introducing Postal Pay

During the quarter ending March 2023, Uganda Post Limited (UPL) forged a partnership with the International Fund for Agricultural Development (IFAD) and Eurogiro to introduce “PostalPay,” a user-friendly app facilitating money transfers to Uganda from Denmark, Netherlands, and Sweden, among other countries.

The PostalPay app users enjoy the convenience of various options to receive their funds, including cash at any Post Bank branch or at a designated Posta Uganda location. Alternatively, they may choose to have the money directly deposited on their bank accounts with Post Bank.

Pay TV coverage

The quarter under review experienced a rise in active Pay TV subscribers, reaching 2.4 million by March 2023, up from 2.3 million in December 2022. This growth in pay TV subscriptions can be attributed to the adoption of various pay-TV packages introduced during the end-of-year season as well as European football leagues.

In terms of content, the quarter witnessed a wide array of channels being offered by all the seven licensed content aggregators, with DStv posting the highest number at 147 and StarTimes following closely with 133 channels.

Local content

During the three-month period concluding in March 2023, the Commission issued its inaugural edition of the Content Monitoring Report. The report offers an overview of the content and local programming accessible through TV and radio broadcasts.

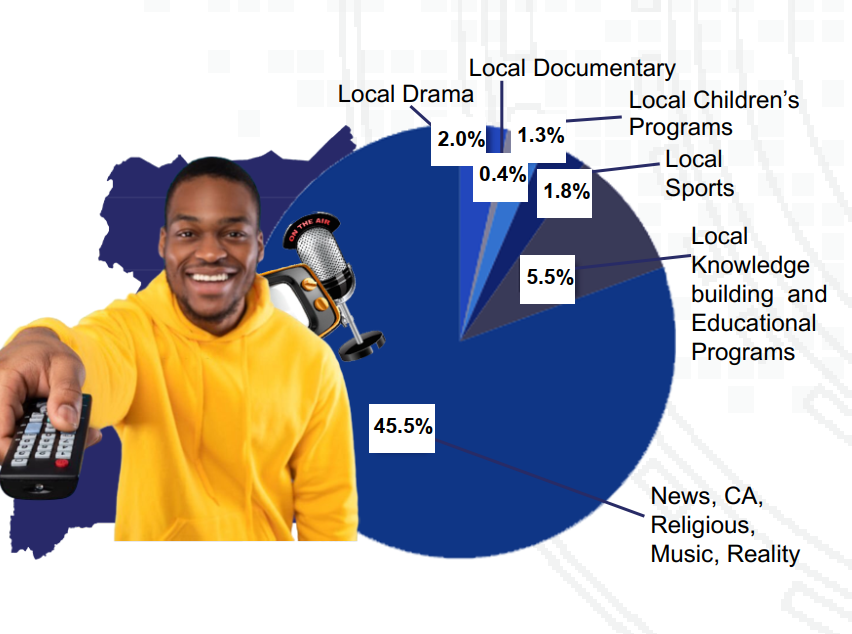

According to the report, news, religious programs, reality shows, and music collectively constituted 45.5% of the content transmitted via TV and radio waves. Local knowledge-building and education accounted for 5.5%, while local drama contributed 2%, among others.

Consumer complaints

A total of 25 complaints targeting TV broadcasting were registered during the quarter. 36% of these complaints were directed towards TV advertisements, closely followed by current affairs programs at 24%. Children’s programming and religion-based complaints were the least prevalent, constituting 4% each. Regarding radio broadcasting, seven complaints were documented, most of them pertaining to current affairs and advertisements.

See full report: https://www.ucc.co.ug/wp-content/uploads/2023/08/UCC-Market-Report-3Q-FY-2022-2023-Jan-Mar-2023-compressed-1.pdf