KAMPALA — One of the main reasons for the early collapse of villages Saccos and Investment groups is poor book keeping. Hell breaks loose whenever the Sacco treasurer loses or conveniently misplaces the company ledger which in turn means there is no track of members’ savings, loans, etc.

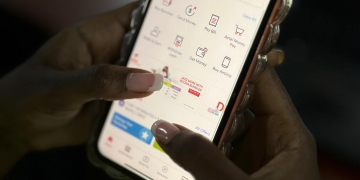

To save such groups from the mayhem that arises out of these scenarios, Kanzu Code, a software development company and FinTech, introduced Kanzu Banking; an online solution that eases financial management.

According to Peter Kakoma, the CEO of Kanzu Code, this platform helps these institutions to manage finances seamlessly in a simple, easy-to-use interface that makes it very possible for them to be evaluated on their viability as entities to invest in.

“More importantly, it increases chances of getting credit from an external institution because if they come in and want to verify your records, you don’t need to pull out a stack of books,” Kakoma says.

Kanzu Code is a technology company that builds inclusive financial solutions for businesses and communities both locally and internationally. For over eight years, they have built customized solutions, websites, mobile applications and enhanced platforms for big organizations such as MTN and NSSF.

“We have served 100 customers in various parts of the world. A substantial percentage of those, over 80 per cent, have been in the US. Locally, with our Kanzu Banking, we are currently serving over 2,000 end users on our platform. Though, right now we are in the process of onboarding over 500 Saccos through a partnership we have with a local bank. So, we are going all over the country and doing that onboarding,” Kakoma explains.

He notes that their current flagship product of Kanzu banking seeks to help women and youths because this is the segment mostly involved in the unbanked micro businesses, constituting more than 60 per cent of village Saccos.

“Many of these women don’t have the profile that would allow them to get credit from traditional financial institutions yet they are five times more likely to get a loan from a Sacco or a village loan and saving scheme to help their business and boost income at home,” he says.

“If you are in an investment club, a Sacco, or money lending business, you need a platform like ours to take you from where you are to the next level in managing your financial portfolio and just make it easy to run that entire entity.”

However, while Kanzu Banking makes it extremely easy for a common person to join, they require some information before one accesses certain credit facilities – following the Know Your Customer (KYC) principles.

But the most important advantage is that they offer same-day settlements.

“Prior to using a platform like ours, you would have challenges where you apply for a facility and takes a bit of time before you can get access to it. So, our system has made such aspects like same day settlements possible,” he says, noting that delays may usually arise if a given Sacco does not have the float to dispense to a loan applicant.

State of Uganda’s FinTech Industry.

Kakoma says that although there are certain steps taken, Uganda’s FinTech industry is still in its infancy.

“There are still areas that have not been digitized like the savings space that will allow people to earn an interest and make micro savings.

Even in the lending space, it still has areas that can be explored. You can also look at the insurance space where micro insurance opportunities have not been explored to the extreme. If you are to look down much further or higher at the crypto space and Web 3 technologies – I think these are also other spaces that offer opportunity because it brings in lower costs, decentralization, etc,” he says.

The high cost of internet and limited reach, according to Kakoma, remains a huge challenge on top of the regulatory issues.

Kanzu Code is participant number 26th in the 2022 40 Days 40 FinTechs initiative.

Kakoma appreciates this initiative and opportunity presented by HiPipo and its partners, noting that through the 40 Days 40 Fintechs initiative, a spotlight is shone on the FinTech Industry and Financial Inclusion in general.

“As these stories are shared, people relate with them and appreciate the power of technology. The more we can make those dots to connect, we can see the benefit of technology beyond the social media aspects of WhatsApp,” he says, before welcoming the idea of making the 40 Days 40 FinTechs initiative regional.

The #40Days40FinTechs platform is run under HiPipo’s Include Everyone program that also encompasses other initiatives such as FinTech Landscape Exhibition, Women in FinTech Hackathon, Summit & Incubator and the Digital and Financial Inclusion Summit and Digital Impact Awards Africa.

The platform aptly provides a setting for the various players and stakeholders involved in digital and financial technology to exhibit their products & Services and also share their ideas on how more of us, especially those unserved and underserved by the present financial systems, can be brought into the fold.

It also offers participants useful tools and an introduction to the industry’s emerging technologies, such as Mojaloop Open Source Software, and guidance from Level One Project foundational material.

The skills gained from this initiative cover Level One Project Principles, Instant and Inclusive Payment Systems (IIPS), Inclusive Finance and FinTech in general.

HiPipo CEO Innocent Kawooya says this year’s edition is cementing the successes of the previous editions – where over 60 FinTechs have been transformed – but also building on them to leverage digital financial inclusion in East Africa and beyond.